Hunting, Farming & Manufacturing Startups, Great Lakes Ice, & Intercity Connectivity

Small Cities Weekly | 03.08.2024

As part of the work we are doing on the Small City Segment, we send out a brief weekly post of thoughts, links, and research in progress that reflect the week’s work. I’d love to hear from you if you have any thoughts, questions, disagreements, or things to add. Please forward this on to people you think might enjoy reading it.

Hunting, Farming, & Manufacturing Startups

Hunting

I grew up in a part of the country where Nov. 15 is a holiday and day off from school - it’s called Safety Day and it marks the opening day of rifle deer hunting season.

Deer hunting is a cultural cornerstone. People plan their falls around it, they buy properties just for it, and for many it has come to mean a special time of bonding between families and friends.

Deer hunting is a game of patience. You observe all year round, stake out a blind, and then sit in silence, waiting for the buck to come. Licenses are limited - you’re allowed up to two antlered deer and one antler-less deer. The season lasts 15 days, so you’re constantly trying to decide if the deer in front of you is the one you want to take a shot at. Once you shoot, little chance you’ll see anything for the rest of the day if you miss. If you hit it, you’ve chosen your harvest for the year, no matter if a better one was right just over the next hill.

If we were to summarize the art of hunting:

You have a few shots, so the ones you take really matter

You are limited by where you choose to hunt; location really matters

There are a limited number of targets that are worth the effort it takes

It’s a game of access - it’s best won by those who know/can get to the right places

It’s mobile - you can pick up and hunt anywhere

Farming

Not unrelated, I also grew up surrounded by farms. My high school’s daily morning announcements were often dominated by ads for summer corn detasseling jobs.

Farming is a bit different than hunting. Hunting requires you think about where is best for what you’re hunting; farming requires you to think about what is best for where you’re farming.

Initial conditions matter a lot. The number of seeds you plant plays a role. Rotating crops is required.

If we were to summarize the art of farming:

Ecosystem and conditions really matter

You can plant good seeds, in good soil, and nurture them well, but a dynamic, uncertain environment means it is hard to predict what will grow in any given season

You can’t move a farm but you can farm from just about anywhere if you understand the local conditions and what will thrive in them

Diversity, resiliency, & long-term thinking matters

Manufacturing

I now live in a city and region whose economy has been built by manufacturing and currently makes up over 30% of our local GDP.

Manufacturing differs from both hunting and farming. Manufacturing is about trying to control variables rather than respond to them. Standardization, predictability, and the removal of uncertainty is what reigns. It costs a lot to get started, but if done well, you can leverage those investments far into the future with limited additional costs.

Everything is about finding efficiencies and reducing variability. Where can time, money, or complexity be reduced? What can we do to make every product exactly the same, no matter where and when it’s produced?

If we were to summarize the art of manufacturing:

You need access to high-quality, low-variability raw materials

Standardization, process, and repeatability are the key

You make big upfront investments that you get leverage out of over time

I’ve been thinking about the analogies of these three activities to the entrepreneurship world lately. Accelerators and venture funding seem closely aligned with the art of hunting. The emerging trend of startup studios seem closely aligned with the art of manufacturing.

But I’ve yet to nail down the analogy in the entrepreneurship world to farming. If there is anything close, it probably exists on the most local level - small businesses emerging from neighborhood needs. I’m curious if and how the analogy can translate to businesses that serve customers outside local communities and import net new dollars into it.

It seems possible that a model built on the principles of the art of farming might better fit the economic development goals and constraints of the types of places we discuss on this newsletter.

If you’ve seen the farming analogy in action in the entrepreneurship world, I’d love to hear about it.

Links

You can find links from this and all previous editions here.

Why small developers are getting squeezed out of the housing market, Coby Lefkowitz, Noahpinion

This brings us to the crux of the issue. Not everyone can execute a real estate development project. It’s risky, difficult, and requires a highly specialized skill set. Banks don’t fully know who will be able to execute at the onset of a project. The best they can do is to work with developers who have a long established track record. Even this is no guarantee of success. But it erects a fairly sizable barrier to entry for smaller, younger, or unproven outfits who don’t have any track record to speak of, to say nothing of a proven one. A catch-22 materializes. The only way to get financing from a bank is to have done projects before, but the only way to have done projects before is to have gotten support from a bank previously. It’s very difficult to enter this loop without having already been in it. It’s sort of like how employers ask for a year of work experience for a job that’s only courting recent graduates. How can you have a year of experience if no one is willing to give you the year of experience you require, because you don’t have a year of experience?

…

These imperatives privilege a concentration of the most well-capitalized firms who have done the most projects before. In 2022, nearly 25% of all multifamily units started in the country (more than 132,000) were commenced by just 25 developers. That’s a strikingly high percentage in a country of more than 60,000 developers. Similar trends exist for new single-family homes. According to the National Association of Home Builders, in 1989 the ten largest builders “captured 8.7% of closings. By the year 2000, the share was 18.7%; and by 2018, 31.5%, reaching above 30% for the first time.” In 2022, that number reached 43.2%.

This is a tough problem to solve in terms of the incentives for the banks, but therefore also seems like an opportunity for new actors to come in and specialize in providing financing for these developers. That financing may need to be provided by or supplemented with development expertise and experience, but for local capital sources, it could be an interesting economic development investment opportunity along multiple dimensions.

Great Lakes Ice, Climate Central

Declining ice cover has cascading impacts on winter cultural heritage across the Great Lakes region as it limits access for recreational (ice skating), subsistence (ice fishing), ceremonial (sacred sites), and educational (citizen science) activities.

Unpredictable, unstable lake ice is also a safety hazard. In recent decades, the highest rates of winter drownings have occurred at times when air temperatures were near freezing, and in communities that rely on lake ice access for livelihoods and Indigenous traditions.

Reduced lake ice can also impact ecosystem health. Declining lake ice and warming surface waters could also lead to increased competition between cool- and warm-water fish species. The regional rise in rainfall extremes can also increase nutrient runoff, creating conditions that promote harmful algal blooms that have cascading ecological effects.

Although less lake ice can potentially extend shipping seasons, ice-free lake surfaces can also enhance evaporation and lead to lower water levels which can in turn restrict shipping.

Larger, longer ice-free lake surfaces also have the potential to increase lake-effect snow, which occurs when cold air flowing over relatively warm, large areas of open water generates intense, localized snowfall downwind of the Great Lakes. Warmer waters and declining ice has likely contributed to the observed increase in snowfall in northern lake-effect zones of Lake Michigan and Lake Superior.

My parents grew up on the Lake Michigan shoreline and I spent much of my childhood summers there. The oceans and polar ice caps get a lot of the play when it comes to talking about climate change, but as the largest freshwater system in the world, changes to the Great Lakes could have a massive impact on the cities whose economies depend on them in varying ways. Through this report I also stumbled upon a project from 2020 called From Rust to Resilience: What climate change means for Great Lakes cities by the Institute for Nonprofit News that includes a lot more on the topic.

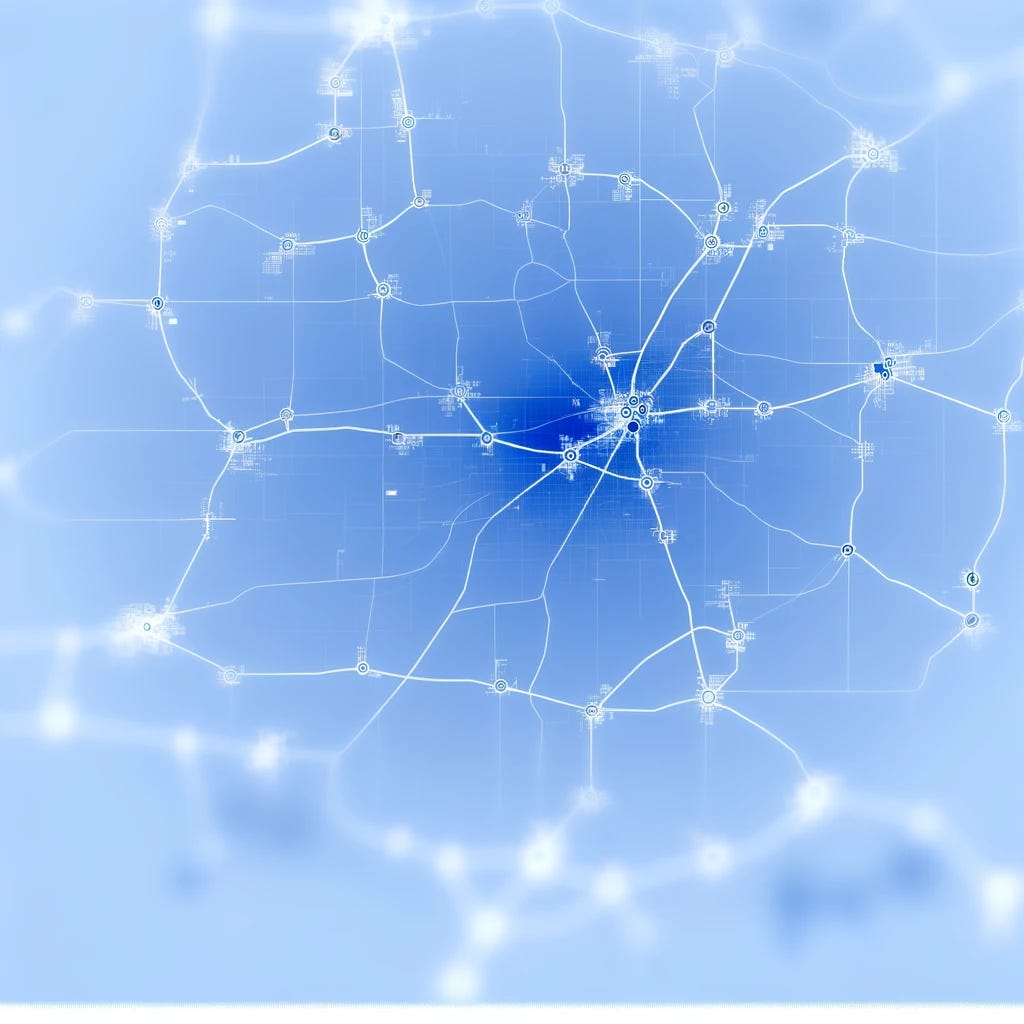

Intercity connectivity and urban innovation, Xiaofan Liang, César A. Hidalgo, Pierre-Alexandre Balland, Siqi Zheng, Jianghao Wang

Urban outputs, from economy to innovation, are known to grow as a power of a city’s population. But, since large cities tend to be central in transportation and communication networks, the effects attributed to city size may be confounded with those of intercity connectivity. Here, we map intercity networks for the world’s two largest economies (the United States and China) to explore whether a city’s position in the networks of communication, human mobility, and scientific collaboration explains variance in a city’s patenting activity that is unaccounted for by its population. We find evidence that models incorporating intercity connectivity outperform population-based models and exhibit stronger predictive power for patenting activity, particularly for technologies of more recent vintage (which we expect to be more complex or sophisticated). The effects of intercity connectivity are more robust in China, even after controlling for population, GDP, and education, but not in the United States once adjusted for GDP and education. This divergence suggests distinct urban network dynamics driving innovation in these regions. In China, models with social media and mobility networks explain more heterogeneity in the scaling of innovation, whereas in the United States, scientific collaboration plays a more significant role. These findings support the significance of a city’s position within the intercity network in shaping its success in innovative activities.

I wrote a piece a few months ago called Grow or Die is Wrong, examining what the research says about the connection between population growth and economic indicators. This piece seems to suggest that there may be a similar dynamic when it comes to innovation - that intercity connectivity might play a larger role in innovation production than pure population, at least for smaller cities. More to come on this - their data is publicly available so I’m trying to run a similar analysis for different sizes of MSAs and I’m also getting the chance to meet the lead author at the University of Michigan next week to talk more about it!

If you…

are interested in building for the small city segment…

are already building for the small city segment…

know someone who might be/should be building for the small city segment…

want to contribute expertise to problem profiles…

or want to help us expand our network in small cities…

please subscribe and reach out at dustin@invanti.co.